Summary: To encourage EAI option holders to exercise their options Ellerston stated on 1 Feb 2019: "There is no underwriting agreement in place for the exercise of the Options." On 27 Feb 2019 - one day before the exercise deadline - it advised: "it intends to undertake a partial underwriting of options."

Details:

- EAI has options expiring on 28 Feb 2019.

- Its share price is trading close to the strike price of $1 so most would normally go unexercised.

- Ellerston has had a recent flurry of articles, interviews, emails and announcements to promote EAI and exercise of the options.

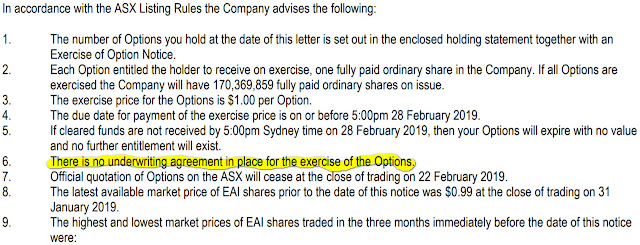

- On 1 Feb 2019 EAI published an ASX announcement stating: "6. There is no underwriting agreement in place for the exercise of the Options." See image below.

- On 27 Feb 2019 EAI published an ASX announcement stating: "Ellerston Asian investments Limited (ASX: EAI) today announces it intends to undertake a partial underwriting of options in respect of the Company’s listed options due to expire on 28 February 2019"

- Shareholders who exercised their options after 1 Feb but before 27 Feb may well question if they have been mislead and disadvantaged by Ellerston choosing to include the statement it made on 1 Feb about no underwriting being in place.

- Holders or purchasers of EAI options (EAIO) after 1 Feb may well question if they have been misled and disadvantaged in concluding that other parties (including Ellerston) who wanted to exercise EAI options (or see them exercised) would have to buy them on-market before they ceased trading on 22 Feb.

- If Ellerston was looking at underwriting the unexercised EAI options before 22 Feb (as is almost certain) then in waiting till after they stopped trading to announce any new information about underwriting it appears to have shortchanged EAI option holders who owned something of value (at least to Ellerston and those who take up the underwriting offer) but is being given away for free without their consent. Indeed, one could ask how it is legal to not buy the options on-market but then claim them after trading is finished without compensation?

- Imagine if in planning for such an eventuality, Ellerston talked to existing large EAI shareholders weeks prior to 27 Feb about a potential underwriting and their interest in participating. It would clearly be a strong reason for such investors not to buy the options on-market (and even sell them if they owned them) as they would pick up the optionality for free after expiry. Meanwhile retail investors in the shares and options are just left in the dark with only the misdirection of the 1 Feb announcement to go on. Presumably, this is all perfectly legal too in Australia's "fair" investing markets?

- Note that a holder of EAI options (who may for example also own EAI shares) who lets some or all of their options expire unexercised is making a decision with their property that suits their interests. It seems strange that it is legal to claim their property and use it to suit someone else's interests without consent or compensation.

Alerts and insights into ASX Listed Managed Investments (LICs, LITs)

Menu

Widgets

Social Links

Search

Popular Posts

Blog Archive

- May 2021 (1)

- August 2019 (1)

- April 2019 (3)

- March 2019 (18)

- February 2019 (1)