Investing Recommendation: MGG has outperformed ACWI by 1.3% annualised between 18 Oct 2017 and 28 Feb 2019. While it continues to outperform its worth considering when trading at the high end of its recent discount range. Fees are not excessive given peers and relative performance.

Trading Recommendation: Trade when discount is at least 2% greater than recent (1 to 6 months) average. Minimum discount advised is 3%.

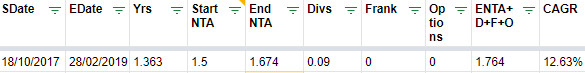

Actual Performance:

In its Feb 2019 monthly report MGG reports the following performance:

Using Excel's CAGR formula I've computed the actual MGG Inception to Date (ITD) performance using the IPO NTA after offer costs ($1.5), 28 Feb 2019 Pre-tax NTA ($1.674), Dividends (9 cents) and Franking (0 cents).

Actual Compound Annual Growth Rate for Pre-tax NTA: 12.63%

- This is close to the 13% ITD Magellan publishes (its figure is based on dividends reinvested which explains the small difference). It's rare to see an accurate ITD figure from a fund manager.

- After 14 Mar 2019 the NAV includes some dilution due to the Feb 2019 Unit Purchase Plan.

Actual TSR Comparison with relevant benchmark ETF:

Using Sharesight and a performance report period of 18 Oct 2017 to 28 Feb 2019 you can accurately determine like-for-like Total Shareholder Return annualised performance between investing in the MGG IPO and investing in the closest index fund to the benchmark.

- MGG has an annualised TSR of 9.84%

- NASDAQ:ACWI has an annualised TSR of 11.31%

- Note that I ignore the IPO benefits for existing Magellan investors and the Feb 2019 Unit Purchase Plan benefits for existing shareholders.

Performance Impact on NTA Discount/Premium:

MGG's 12.63% NTA CAGR is higher than ACWI's 11.31% for the same period. Meanwhile its TSR is lagging at 9.84%. I expect that, while it continues to outperform, the higher end of its discount ranges will be good buying opportunities as it will tend toward trading at NAV or occasionally small premiums.

Management and Performance Fees:

Management Fee

1.35% per annum (inc GST)

Performance Fee

10.0% of the excess return of the units of the Fund above the higher of the Index Relative Hurdle (MSCI World Net Total Return Index (AUD)) and the Absolute Return Hurdle (the yield of 10-year Australian Government Bonds). Additionally, the Performance Fees are subject to a high water mark.